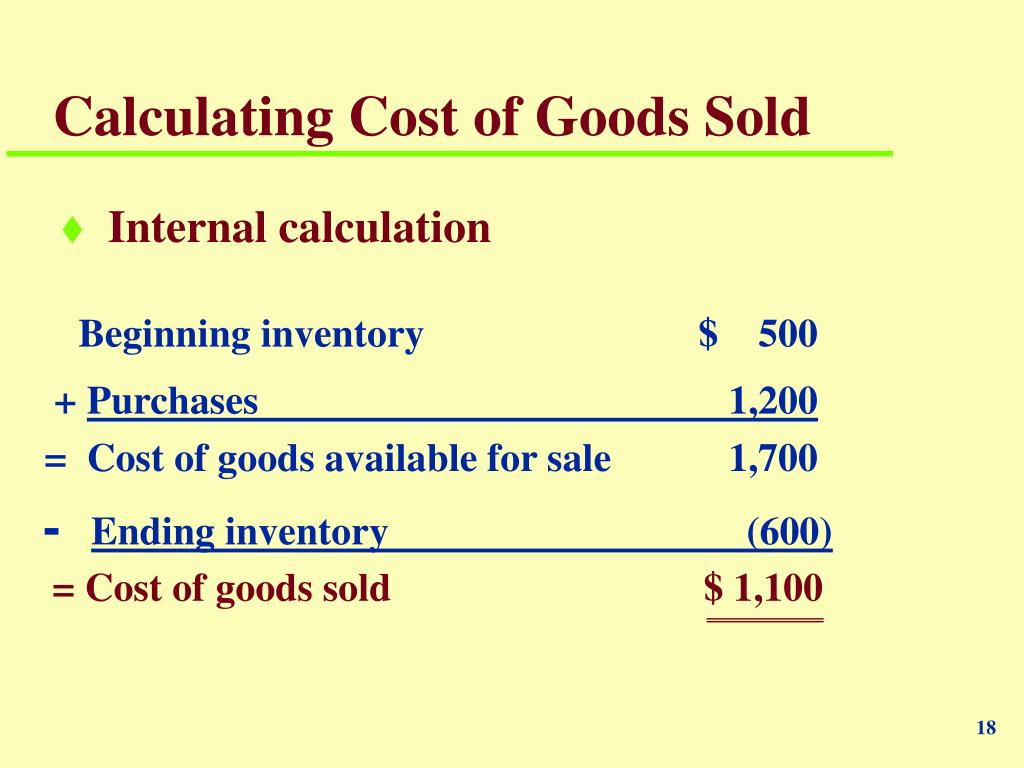

Calculate net income: This helps you determine what you make on what you’re selling.Match recorded inventory to actual inventory: This lets you match your inventory balance sheet with your stock list so that you can identify inventory shrinkage due to loss, theft, spoilage, etc.Find the cost of goods sold (COGS): Finding COGS lets you find your gross profit and margins and identify ways to improve inventory ordering.Why is it important to calculate ending inventory?Ĭalculating ending inventory is important for a handful of reasons, including: Knowing your ending inventory value will impact your balance sheets and taxes, so it’s important to calculate your inventory value correctly. For a balance sheet to be complete, you’ll need to claim all inventory as an asset. When a given accounting period ends, you take your beginning inventory, add net purchases, and subtract the cost of goods sold (COGS) to find your ending inventory’s value. Why is it important to calculate ending inventory?Įnding inventory refers to the sellable inventory you have left over at the end of an accounting period.

The ending inventory is based on the market value or the lowest value of the business’s goods. This provides the final value of the inventory at the end of the accounting period. The new purchases are added to the ending inventory to calculate the ending inventory minus the cost of goods sold. Understanding your ending inventory will help you sell more products and help you forecast marketing and sales for the upcoming month, quarter, or year. The ending inventory formula is a valuable tool to help companies better understand the total value of products they still have for sale at the end of an accounting period.

0 kommentar(er)

0 kommentar(er)